Cyber Liability Insurance Compliance

Secure and Safe.

In the digital age, criminals don't even have to leave their house to steal money or personal information from businesses of any size or industry, and unfortunately, all it can take is one security flaw or employee to compromise your entire operation. Many industry leaders are turning towards cyber security experts and insurance companies to ensure they are as secure as possible, and their assets are covered.

What is Cyber Insurance?

Cyber insurance, also called cyber liability insurance or cybersecurity insurance, is a insurance policy that helps businesses cover the financial losses resulting from a cyber attack. This can include data breaches, malware attacks, and other forms of cyber crime. Unlike traditional insurance policies that cover tangible assets, cyber insurance focuses on intangible, digital assets.

What Exactly Does Cyber Insurance Cover?

Cyberattacks can lead to a wide range of damages, so cyber insurance policies are specifically designed to deal with various consequences an organization might face post-breach, including:

- Incident Response: When an IT professional investigates a cyber attack, this often times leads to significant costs to investigate the breach and restore the security status of your organization.

- Legal Fees: The legal landscape surrounding data breaches has become increasingly complex. Depending on the nature and scale of the breach, affected businesses might face lawsuits from customers, stakeholders, or even partners. Thus, cyber insurance policies typically cover legal consultations, defense costs, and possible settlements stemming from the breach.

- Regulatory Fines: With stringent data protection regulations like GDPR and CCPA in play, non-compliance after a breach can lead to hefty penalties. Cyber insurance helps protect businesses from the financial blow of such regulatory fines, ensuring they don’t bear the brunt of non-compliance alone.

- Loss of Income: Cyber incidents can halt a company’s operations, sometimes for extended periods, resulting in substantial revenue loss. Cyber insurance policies can cover the loss of income during these downtimes, helping the business remain financially stable even when operations are compromised.,

Call now to secure your business (561) 223-2177

Do I need Cyber Insurance?

No matter what industry you're in, if you are connected to the digital world in some way, there will likely be significant (and unforeseen) damage if you are compromised. Whether it’s customer information, intellectual property, or internal communications, this data must be kept safe, because any data breach can have devastating financial and reputational impacts.

Becoming Cyber Insurance Compliant

- Cyber Security Insurance Assessment: When you purchase a Cyber Security Insurance Policy, your insurer will require you to complete a Cyber Security Assessment, which usually has questions that only an IT professional will understand. We are well versed in this process and will help you every step of the way to complete this assessment.

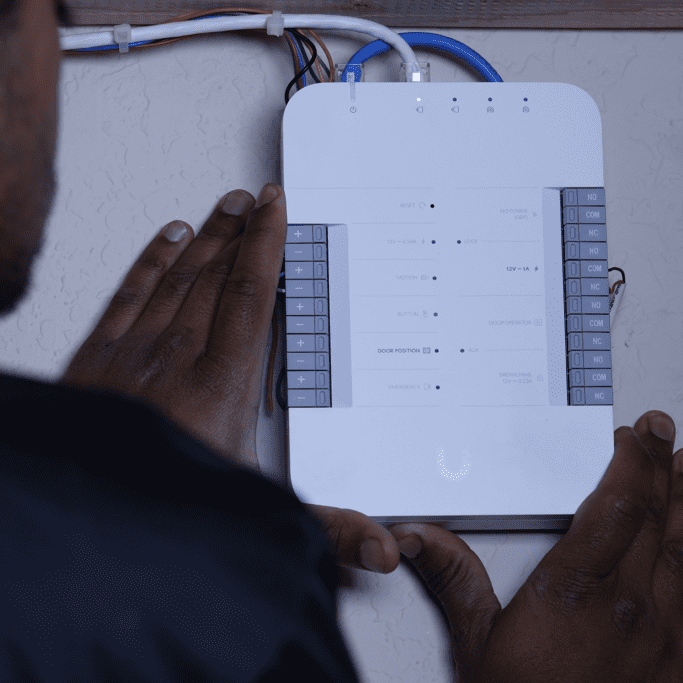

- Access Control: This is usually an overlooked, but important part of cyber security and the first line of defense against bad actors or employees inadvertently tampering with your equipment. Using an access control system, with door controls and access cards, we can effectively prevent access to rooms with important IT equipment and data.

- Regular Vulnerability Assessments: New cyber vulnerabilities emerge every day, which is why insurers require regular cyber security checks. These assessments act as the organization’s health checkup, spotting weak links before they can be exploited. We can help complete these regular vulnerability assessments.

- Incident Response Plan: An Incident Response Plan ensures everyone knows their roles and responsibilities when a threat is detected so that there is no time wasted. Swift action can significantly mitigate the damage caused by a cyber incident, and a proper incident response plan ensures this action is also strategic and well-coordinated.

- Employee Training: When it comes to cybersecurity efforts, employees can be an organization’s greatest asset or it’s greatest weakness. Regular training ensures every member of the organization is equipped to defend against and detect cyber threats. A well-informed workforce can prevent breaches, and be ready to respond effectively when threats do emerge. Training modules often cover phishing threats, best practices for password creation and management, and how to report potential threats, among other key topics.

What Happens if Your Organization Fails to Comply with Cyber Insurance Policy Requirements?

Non-compliance can be detrimental. Not only can it lead to a denial of insurance claims, but premiums can also rise significantly. Also, the insurer may deem the organization as "high-risk" and potentially revoke coverage.

For these reasons, it is essential to continuously review and update cybersecurity measures to ensure they align with the insurer’s requirements. Many organizations determine that the most effective route is to partner with an expert cybersecurity team, entrusting professionals to keep their cybersecurity aligned with both insurance expectations and overall best practices.

Call now to ensure your initial compliance, and to stay compliant, with your Cyber Liability Insurance - (561) 223-2177